The so-called Say's Law is one of them.

In Chapter II.3 ("Of the Accumulation of Capital, or of Productive and Unproductive Labour") Smith discusses his theory of capital accumulation. For Smith, the foremost feature of an economy was its capacity to grow, to produce increasing physical surplus (i.e. outputs in excess of inputs).

|

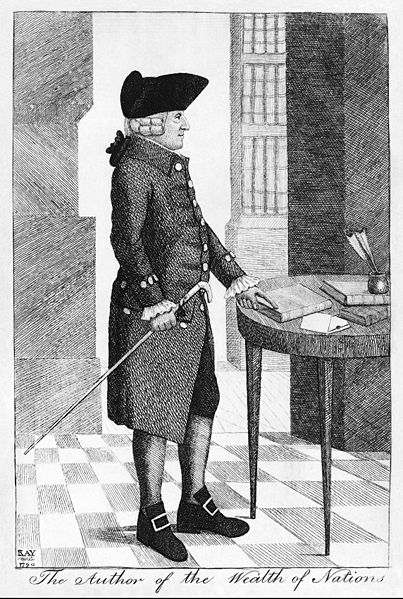

| Adam Smith, engraving by John Kay (1790). [A] |

"Capitals are increased by parsimony, and diminished by prodigality and misconduct.So, savings was, in Smith's view, what makes capital grow: what's not consumed is saved. Note carefully: Smith defines savings as non-consumption; hoarding was ruled out by hypothesis.

"Whatever a person saves from his revenue he adds to his capital, and either employs it himself in maintaining an additional number of productive hands, or enables some other person to do so (...)."

But how does it work?

Whether consumed or invested, profits are used to pay for labour, goods and services.

If invested:

"(...) That portion which he annually saves, as, for the sake of the profit, it is immediately employed as a capital, is consumed in the same manner, and nearly in the same time too, but by a different set of people: by labourers, manufacturers, and artificers, who reproduce, with a profit, the value of their annual consumption."If it is consumed, "there is nothing behind them in return for their consumption". If idle consumption were excessive, there would be little left for investment, and the economy would slow or even stagnate.

This idea encapsulates what would later be known as Say's Law.

(Incidentally, you see why the chapter referred to unproductive and productive labour: labour employed in increasing production was called "productive". That's where landowners played a major role: in Smith's views they had a distressing tendency to engage in high living, employing non-productive labour.).

To reiterate, the unstated and unexamined assumption was that hoarding was, by definition, ruled out. Presumably, Smith thought hoarding was always, invariably, irrational and, thus, outside economic theorizing.

But if in Smith the assumption can only be inferred, J.B. Say ("A Treatise in Political Economy", Book I, Chaper XV, "Of the Demand for Market Products") gives it

explicitly:

That's why Say considered "that it is production which opens a demand for products": "money performs but a momentary function in this double exchange; and when the transaction is finally closed, it will always be found, that one kind of commodity has been exchanged for another.""When the producer has put the finishing hand to his product, he is most anxious to sell it immediately, lest its value should diminish in his hands. Nor is he less anxious to dispose of the money he may get for it; for the value of money is also perishable. But the only way of getting rid of money is in the purchase of some product or other."

Jean-Baptiste Say [B]

So, for Say it was out of the question that a producer would hoard produce or money: both were perishable and could lose value. Say assumed it was always irrational to hoard either money or commodities, presumably as Smith did.

Unlike some critics claim, neither Smith nor Say were considering a barter economy in any literal sense. To believe otherwise is absurd, as both men lived in a (mostly) monetary economy and were theorizing on that basis.

In practice, however, their model of this monetary economy acted like a barter economy, due to the assumption that is was irrational to hoard: money and stocks of commodities were hot potatoes, and no one holds a hot potato for long.

Image Credits:

[A] Adam Smith, engraving by John Kay (1790). Public domain. Wikipedia.

[B] Jean-Baptiste Say. Public domain. Wikipedia.

Update:

Prof. Nick Rowe (Carleton University, Ottawa, Canada) is a fairly conservative, mainstream economist.

I've found a relatively recent post ("Why 'saving' should be abolished", January 11) where he deals with some of the subjects treated here.

In my opinion, it's a bit of a mixed bag. But I can't help but agree with this:

"An individual's saving means anything he does with his income except spend it on newly-produced consumption.I only wish he was consistent with this, particularly in the first part of the post. Oh, well!

"Saving isn't a thing, it's a non-thing. It's a residual. It's defined negatively, as not consuming part of your income. So when an individual increases his saving, for a given income, all we know for sure is that he is reducing his consumption. He must be increasing something else, but we don't know what it is he is increasing. We know (in this model) that he must be: buying more investment; buying more antiques; or hoarding more money. But we don't know which. And it really matters which. As I shall show." (my emphasis)

Smith’s point about capital is not relevant is it? That is, one could have an economy where capital was non existent or of minimal significance, e.g. an economy where people fed themselves simply by picking fruit off wild fruit trees. But in such an economy, Say’s point about producing in order to be able to purchase would still hold. I.e. one person might specialise in picking one type of fruit with a view to selling it and purchasing another type of fruit.

ReplyDelete"Smith’s point about capital is not relevant is it? That is, one could have an economy where capital was non existent or of minimal significance, e.g. an economy where people fed themselves simply by picking fruit off wild fruit trees."

ReplyDeleteI don't quite understand your question. So, apologies in advance if I am missing your point.

In any case, let me begin with your hypothetical fruit-picking economy.

In one such economy, where presumably all goods are perishable, I can see no reason for Say's Law not to operate, in the sense that nothing would stop individuals in that economy from producing for exchange. It sounds far-fetched, to me, as economies that primitive hardly produce any surplus that could be exchanged; but it certainly is not impossible.

Much more likely, one would have a "gift" economy: "Hey guys, I found plenty bananas, more than I can eat, have some!", in the understanding that later on, if I needed something, some of them may feel inclined to help me, because I'm such a nice guy.

Say, the big guy is bullying me, so my friends may intervene. Or one of them is good finding eggs: some day he may give me some.

Even more likely, one would consume one's meager pickings and/or share them with their close dependents.

This, incidentally, is what primitive hunter-gatherers used to do. And what our close cousins, the chimps, seem to do.

----------

About capital and the discussion on Say's Law: what makes you believe it is irrelevant?

I'm not sure what Rowe is looking for when he discusses saving. I do think too much is expected from it, as though by necessity it must encapsulate some critical variable we can't see. When we save we decrease a flow of expenditure in favor of increasing a stock. We may not b able to derive much more than this.

ReplyDelete