(From Part vi)

"In IS-LM models there is always something in the background shifting the IS curve. What is it? In my view that 'something' is Keynes' animal spirits (…)." (Roger Farmer, here)

|

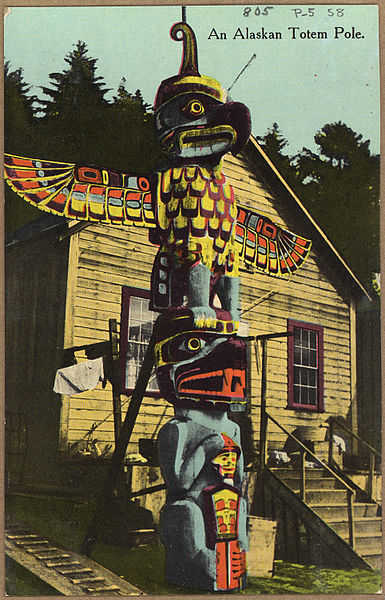

| Animal Spirits in Alaska. [A] |

However -- for reasons beyond the role of Animal Spirits -- the IS-LM model is one point of long-running and irreconcilable dispute between economists like New Keynesian Paul Krugman, and a host of Post Keynesians (for instance, Steve Keen -- here, Krugman's reply -- and Lars P. Syll -- here, Krugman's reply -- among the more consistently opposed; Mario Seccareccia and Marc Lavoie, among the occasional commenters). A few, like Matías Vernengo, seem more accepting of the IS-LM (here and here).

Luckily, one can still illustrate the role of Animal Spirits with the use of a more basic concept, whose validity is -- to my knowledge -- accepted by virtually every Keynesian economist, regardless of prefixes: Keynes' multiplier.

The equation below -- from Dornbusch and Fischer (1994), page 71 -- shows the equilibrium income (Yo) for a capitalist economy, with government but no foreign trade (Marxist/Post Keynesian economist Peter Cooper offers a derivation, for a model with additional foreign trade):

1

Yo = --------------------(Co + Io + Go + c TRo)

1 - c (1 - t)

TRo government transfers

Go government spending (non transfers)

Co autonomous consumption

Io autonomous investment

The multiplier is shown in red. For reasonable values of c (marginal propensity to consume: Keynes' "psychological propensity to consume") and t (tax rate), the multiplier is a number larger than 1.

In blue, within parentheses, are the aggregate autonomous demand (AAD): "exogenous variables" (i.e. not determined within the model).

But, where are the "Animal Spirits"…?

Hiding inside Co, Io, and c!

Suppose "keynes" -- short for the "average business man" -- feels a bit under the weather and reduces autonomous investment to I1: AAD falls. Multiplied by, well, the multiplier (which didn't change) it yields a smaller Y (say, Y1).

Less workers are needed to produce Y1 than were needed to produce Yo: employment falls, too. An unpredictable change in "spontaneous optimism" causes a fall in autonomous private investment, causing AAD to fall, causing output and employment to fall. Animal Spirits set a recession in motion.

Enter Hicks/Krugman. The government may not control Io, Co, or c, but it controls TRo and Go. If the government increases either of them -- a.k.a. fiscal stimulus -- just enough to offset the shortfall in AAD, the Y recovers to the level of Yo (say Y2 = Yo).

The mechanism -- in this minimalist model -- is deterministic. Randomness intervenes only as the initial exogenous shock; after that, output and employment (plus interest rate and inflation) are predictable:

"And as I have often argued, these past 6 or 7 years have in fact been a triumph for IS-LM. Those of us using IS-LM made predictions about the quiescence of interest rates and inflation that were ridiculed by many on the right, but have been completely borne out in practice. (…) " (Paul Krugman, "Unreal Keynesians")This is the happy ending for Keynesians like Hicks and Krugman (and, apparently, to some Post Keynesians like Cooper and Vernengo): Animal Spirits dropped out of the blue and struck once, but the recession was -- predictably -- solved.

However, that -- as we've seen and as Post Keynesians have insistently argued -- was not necessarily Keynes' happy ending ("If the fear of a Labour Government or a New Deal depresses enterprise, this need not be the result either of a reasonable calculation or of a plot with political intent; it is the mere consequence of upsetting the delicate balance of spontaneous optimism").

It certainly isn't the happy ending for "Austerians": What if the mere announcement of fiscal stimulus further scares "keynes", who again slashes autonomous investment? What if the "psychological propensity to consume", c, falls and with it the multiplier? What if, in other words, Animal Spirits are not exogenous and become the Confidence Fairy?

There's no a priori reason stopping Animal Spirits from striking again.

In more philosophical terms: If the economy, ultra-sensitive to the intestines of "keynes", were unpredictable (uncertain) … -- or, like Old Keynesian economist Paul Davidson likes to say, non-ergodic -- wouldn't that mean that the effects of stabilization policies are also uncertain, unpredictable, non-ergodic, even counterproductive?

----------

References

Dornbusch, R. and Fischer, S. (1994). Macroeconomics. New York: McGraw-Hill

Image Credits:

[A] Totem in Alaska. National Archives and Records Administration. This work is in the public domain. Wikipedia.

No comments:

Post a Comment