"wageWith wages, things work like this: you perform a task, you do something which your employer deems necessary, and your employer pays you for that, usually after you've done whatever it is you had to do.

"noun

"plural noun: wages

"1. a fixed regular payment earned for work or services, typically paid on a daily or weekly basis.

"'we were struggling to get better wages'

"synonyms: pay, payment, remuneration, salary, emolument, stipend, fee, allowance, honorarium; More" (see here)

For example: you are the tea lady, you serve tea, coffee and cookies. You are the company's accountant, you keep the company's accounting books. You are the CEO, you run the firm. You do your job, you are paid; you don't do your job, you are not paid. Easy.

It's all about work.

"profit

"noun

"1. a financial gain, especially the difference between the amount earned and the amount spent in buying, operating, or producing something.

"'record pre-tax profits'

"synonyms: financial gain, gain, return(s), payback, dividend, interest, yield, surplus, excess; More" (see here)

With profits, things are this way: you own a business or a share of a business and you are paid for that, in proportion to your share. The same with losses. You don't own a business or part of a business, you don't get any profits (or suffer any losses). Period.

For instance, if you buy shares in the Stock Exchange, you don't need to know what the company listed as ABCXYZ does, or what that symbol means. You don't need to run the company, work there, or move a finger: you'll get dividends, for the amount the company decides, whenever it decides, in proportion to the stock you hold; and as a stockholder you have your say in that decision. Easy.

It's all about ownership.

----------

What if Joe, who is the firm's CEO (or Maggie, the tea lady or Bob, the accountant, for that matter), also owns shares? He is the big boss and also a shareholder: he gets his salary for doing his job (as any other employee/worker) plus dividends (as any other shareholder). Two different roles, two different incomes.

Each and every single one of them knows that those two sources of income are different. If Joe quits his job but keeps his shares, he'll keep receiving dividends; if he sells his shares but keeps his job, that won't stop him from demanding his salary payments.

If Joe dies -- God forbid -- his estate will keep receiving dividends, potentially per saecula saeculorum (unless the shares are sold); but bye, bye to CEO compensation.

----------

Update:

(19/08/2014): Does it mean that CEOs, like Joe, are in the exact same position as tea ladies, like Maggie, or accountants, like Bob?

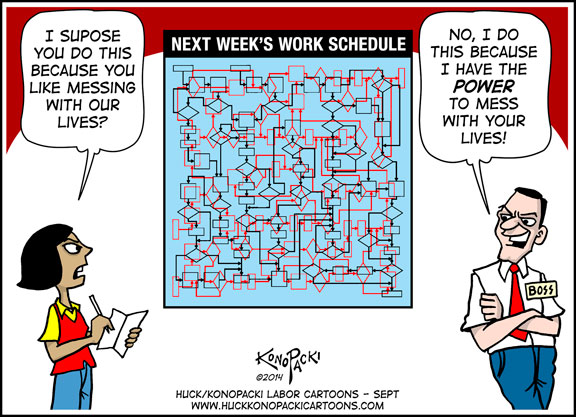

Let the cartoon below (h/t David Ruccio) answer that question:

That's his job.

Since the late 1960s, less than 20 percent of all publicly traded companies in the US issue dividends on a regular basis. These days, it is all about the appreciation of stock price for 80+ percent of all companies, which means that CEOs and other executives sell their shares as they issue.

ReplyDeleteHi Tao,

ReplyDeleteLet's think of this in terms of accounting.

When dividends are deposited in a shareholder's bank account, the shareholder registers the inflow of money (note the word, inflow: the payment is a flow) as a an income. In this sense, it's similar to you, when your employer deposits your paycheck in your account.

The inflows, whether wages or dividends, may or may not affect the respective balance sheets (yours and the shareholder's) and they are paid by the firm that employs you and is part-owned by the shareholder. The firm, seen as an independent entity, gets poorer.

For simplicity's sake, let's leave out rents, interests and indirect taxes. Added together, and before income taxes, all wages and all dividends/profits paid amount to GDP (that's why GDP, which is also a flow, can be approximately decomposed into wage and profit).

However, when a share price changes, the shareholder's balance sheet is necessarily affected, bypassing her statement of income and losses (think of income tax declaration). Strictly speaking, this is neither an inflow nor an outflow. The shareholder registers a capital gain (or loss): her wealth (a level/stock) changes, without a corresponding flow.

(I understand that different taxation laws may treat this differently, but those are arbitrary decisions, which do not change the basic accounting logic).

This change is not part of the nation's GDP (which, I repeat, is a flow). In fact, it's not part of the nation's balance sheet (which excludes financial assets), either. If the shareholder sells her shares, she gets one asset (cash) in exchange for an equally valued asset of her own (shares). Similarly, the buyer gets an asset (shares), in payment for another (cash). The transaction, per se, did not make anybody richer or poorer (unlike the firm, that gets poorer by paying wages and dividends).

This ties in nicely with the notion of exploitation: if the firm gets poorer by paying both wages and dividends, why dividends alone constitute exploitation? Because the workers gave the firm something valuable in exchange for their wages (they worked for the firm), while shareholders did not give the firm anything in exchange for her dividends.

If the workers owned the firm, the amount it would pay as dividends would be available to the workers, either to re-invest or to take home. Or, from a slightly different perspective, the workers are working harder/longer so that the shareholders live without working.

There is a lot more to this, but I'll leave that for another time. In particular, Rudolf Hilferding (a Marxist theoretician from Austria) wrote about financial capital, if you are interested. Capital volume 3 also contains some considerations on this matter.

Others have also written about this, but I haven't read them, yet.