Tuesday, 30 June 2015

Merkel to Tsipras: Nein!

According to Reuters/The Sydney Morning Herald (published locally at 3:36 AM AEST), German chancellor Angela Merkel "has ruled out new negotiations with Greece until after it votes on a proposal from creditors, leaving virtually no hope left to avert a midnight default despite a plea from Athens for a last-minute bailout extension." (here)

This comes after the Greek government, during the last hours of June 30th, asked for a deal before bailout expired, while thousands of Yes supporters protest before the Greek Parliament. (here)

Monday, 29 June 2015

Movie Trailer: "Dead Oz-Now".

Eight days ago, a group of happy ABC staffers ventured into the Perisher wilderness for a holiday of sex and fun in the snow; instead they just found out that the legend of the evil Nazi-zombie Malcolm von Abbott was true …

Based on real life events …

----------

In the meantime …

|

| (see here, or here) |

The Attack of the Animal Spirits.

Well, it would seem the Animal Spirits of many "average business men" (or "keyneses", for short) are currently (4:45 AM Tuesday, 30 June 2015, AEST, GMT+10) rather subdued:

|

| (Right-click to open another tab with a larger image. source) |

|

| (Right-click to open another tab with a larger image. source) |

----------

M. Hollande and Frau Merkel reach out to Tsipras; while M. Juncker, barely suppressing a tear, feels "betrayed" (poor, poor thing).

Aussie markets: "$36 billion wiped off Australian stocks" (like, ouch!)

And today's the day! One step closer

Aussie markets: "$36 billion wiped off Australian stocks" (like, ouch!)

----------

Friday, 26 June 2015

Greece: Bailout Referendum Announced.

It seemed inevitable (see here and here) and it's one very important step closer:

The Sydney Morning Herald:

Greek Prime Minister Alexis Tsipras calls for referendum on aid package

Date June 27, 2015 - 9:09AM

Birgit Jennen, Nikos Chrysoloras and Rebecca Christie

The BBC:

Greece debt crisis: Tsipras announces bailout referendum

22 minutes ago

----------

This should be a test for the powers of Keynes' mythical Animal Spirits/Confidence Fairy.

Thursday, 18 June 2015

"LOL-Fallacy" Fallacy Down Under.

Just when you thought it was safe to read online opinion, Patrick Carvalho -- from the clearly self-desinterested propertarian think tank Centre for Independent Studies -- demonstrates that Aussie pundits have nothing to envy their foreign counterparts:

Yes, that's right: the LOL Fallacy fallacy arrived to Oz. I feel so proud: "Aussie, Aussie, Aussie, Oi, Oi, Oi".

----------

I blame you, Sandwichman, for that.

Wednesday, 17 June 2015

Furtwängler and the End of History.

"The history of all hitherto existing society is the history of class struggles.

"Freeman and slave, patrician and plebeian, lord and serf, guild-master and journeyman, in a word, oppressor and oppressed, stood in constant opposition to one another, carried on an uninterrupted, now hidden, now open fight, a fight that each time ended, either in a revolutionary reconstitution of society at large, or in the common ruin of the contending classes." (Karl Marx/Friedrich Engels, "The Communist Manifesto")

"[I]f the whole of modern society is not to perish, a revolution in the mode of production and distribution must take place, a revolution which will put an end to all class distinctions. (…) [O]n this fact, and not on the conceptions of justice and injustice held by any armchair philosopher, is modern socialism's confidence in victory founded." (Friedrich Engels, "Anti-Dühring")

----------

To me, there is something epically tragic in this recording. Wilhelm Furtwängler conduces Siegfried's Funeral March, Third Act, Götterdämmerung:

If we lose our fight, that could be the closing titles to human history.

----------

Your call.

Thursday, 11 June 2015

The Horror of the Confidence Fairy (and viii)

(From Part vii)

"The impression of Keynes that one gains [reading his interpreters] is that of a Delphic oracle, half-hidden in billowing fumes, mouthing earth-shattering profundities whilst in a senseless trance -- an oracle revered for his powers, to be sure, but not worthy of the same respect as that accorded to the High Priests whose function it is to interpret the revelations." (Axel Leijonhufvud, quoted here)Studying a minimalist Keynesian model -- the income determination model -- we've seen what role Animal Spirits play among Keynesian infidels: by assumption, it strikes once and with enough power to throw the economy into a recession. But, there's no a priori reason supporting that assumption.

So far, we have considered the contradictions popping up when Keynes, non-ergodicity, Animal Spirits, are allowed to change the scenario above, as the Keynesian literalists demand. The end result, a powerful -- if ironic -- defense of laissez-faire: capitalism may suck big time, but reform/intervention could make things worse, through non-ergodicity.

For those intent on preserving Keynes' legacy at any cost and selling Keynesianism as the way for the Left, the road leading from Keynes to Hayek seems not so much of reconciliation, but of capitulation.

----------

Let's turn our gaze to the other side of the Keynesian religious war: the apostates. Among them -- de facto -- Keynes, non-ergodicity, Animal Spirits no longer reign. That's probably a good thing.

However, while one could suspect apostates regard their pious opponents' faith with little respect, don't expect open admissions of apostasy from them. For reasons we better omit, you won't see many Keynesians ever coming out -- proud and loud -- of the anti-Keynesian closet, and apostates, too, will still pay lip service to Our Lord. (Suffice it to say that there is a strong cultish element in economics in general, particularly evident in Keynesianism -- and, no, Marxists aren't immune, either).

But if Animal Spirits do not cause slumps, well, what does?

Apostates may be able to cure recessions, as claimed, and experience seems to confirm; they may be able to predict the economy's behaviour. But -- at least based on the Master's teachings -- they don't know what caused the disease, in the first place. Beyond generalities about aggregate demand, they have no explanation. In fact, they don't know they don't know.

|

| Deus Ex Machina Man, by Phil Foglio. (source) |

They, in other words, lack a theory of crisis. But the search for one -- ironically, too -- could lead these economists -- often considered Centre-Left -- away from a comfortable deus ex machina and into troublesome places:

"For it was Keynes, not Marx, who cracked the code of crisis economics -- who explained how recessions and depressions can happen." (here)There may -- after all -- be something wrong with capitalism.

It's hard to tell which of his competing crises theories Marx would have supported: he died before clarifying his views. But this passage seems highly suggestive:

"The ultimate reason for all real crises always remains the poverty and restricted consumption of the masses as opposed to the drive of capitalist production to develop the productive forces as though only the absolute consuming power of society constituted their limit." (here)

----------

The internal inconsistencies of Keynesianism have a way to come back to haunt Keynesians, don't they?

Post Keynesians, the self-appointed alternative, may keep Keynes' thought, but at the cost of Keynesian policies. Mainstream Keynesians may keep Keynesian policies, at the cost of Keynes' thought. (Update: 09-09-2015 see here; yet another update, 19-05-2016, because it's really cool to be proven right)

Which, if any, of those two paths will Keynesians take? Faithfulness to the Master, or Apostasy? Faced with this dilemma, Lord Skidelsky seemed to join mainstream Apostasy, after debating Paul Krugman, a chief apostate. In a supreme irony, apparently Hicks himself moved in the opposite direction, influenced by Paul Davidson.

This may depend on how personally invested one is in Keynes' hero-worship: Keynesians are a diverse bunch.

One option is to ignore the contradictions. This should prove popular: go on about one's business.

Another approach, open to high-profile mainstream Keynesians actively involved in promoting Government intervention, requires discreetly jettisoning Keynes, whenever hounded by the more recalcitrant loyalists:

"One way to answer this is to point out that Keynes said a lot of things, not all consistent with each other. (…)

"But surely we don't want to do economics via textual analysis of the masters. The questions one should ask about any economic approach are whether it helps us understand what's going on, and whether it provides useful guidance for decisions." (here)Those closer to the classical political economists, particularly Marx and Sraffa, and/or to MMT, should find it easier to distance themselves from the Master (Update: 09-09-2015 see here). Some of them have already started down that path, anyway: the idea that capitalism may have something inherently self-destructive should not be alien to them.

It is those highly visible and vocal heterodox, ideologically and philosophically (some of them, politically) closer to the Austrian School, who may face a more serious challenge. Having built their group identity as alternative in strident opposition to mainstream Keynesians, neoclassicals, and Austrians, and around their strict adherence to

And, apart from the contradiction treated here, there is also the issue of Keynes' own attitude towards neoclassicism. Not Kosher, definitely.

In retrospect, it was always doubtful they would have ever gained a significant foothold in academy. Perhaps now it's more a matter of whether they will eventually lose steam and subsist as a kind of fringe group, as so many other economic fads, or simply vanish. However, among the Austrians there are already those who think in terms of Austrian/Keynesian syncretism: keep an eye on this space.

Realistically, while the issues at stake are serious, this is unlikely to result in a paradigm shift against the whole of Keynesianism, although it should come very close to that for some of its sects.

----------

As the Great Recession fades from memory, it's likely that the movement calling for a renewal of economic thinking and education it's already past its peak and changes achieved, if any, should be marginal.

It may be mere coincidence, but the parallel between most of Post Keynesianism and new political pseudo-Left parties product of the crisis, like Syriza, seems striking: too many expectations, too little substance.

While I regret the lost opportunity, seeing the contradictions in what for a time looked like one of the main alternatives, it's hard to say whether that's such a bad thing.

Image Credits:

I found that image on the internet. If readers know for a fact I am infringing anyone's property rights, please leave a comment and, at your discretion, I will either remove the image or provide full credits.

Tuesday, 9 June 2015

Saturday, 6 June 2015

The Horror of the Confidence Fairy (part vii)

(From Part vi)

"In IS-LM models there is always something in the background shifting the IS curve. What is it? In my view that 'something' is Keynes' animal spirits (…)." (Roger Farmer, here)

|

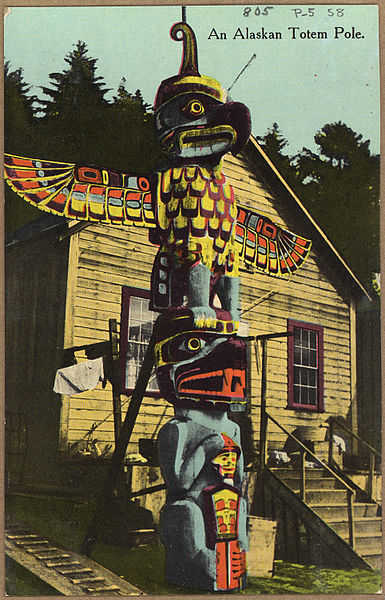

| Animal Spirits in Alaska. [A] |

However -- for reasons beyond the role of Animal Spirits -- the IS-LM model is one point of long-running and irreconcilable dispute between economists like New Keynesian Paul Krugman, and a host of Post Keynesians (for instance, Steve Keen -- here, Krugman's reply -- and Lars P. Syll -- here, Krugman's reply -- among the more consistently opposed; Mario Seccareccia and Marc Lavoie, among the occasional commenters). A few, like Matías Vernengo, seem more accepting of the IS-LM (here and here).

Luckily, one can still illustrate the role of Animal Spirits with the use of a more basic concept, whose validity is -- to my knowledge -- accepted by virtually every Keynesian economist, regardless of prefixes: Keynes' multiplier.

The equation below -- from Dornbusch and Fischer (1994), page 71 -- shows the equilibrium income (Yo) for a capitalist economy, with government but no foreign trade (Marxist/Post Keynesian economist Peter Cooper offers a derivation, for a model with additional foreign trade):

1

Yo = --------------------(Co + Io + Go + c TRo)

1 - c (1 - t)

TRo government transfers

Go government spending (non transfers)

Co autonomous consumption

Io autonomous investment

The multiplier is shown in red. For reasonable values of c (marginal propensity to consume: Keynes' "psychological propensity to consume") and t (tax rate), the multiplier is a number larger than 1.

In blue, within parentheses, are the aggregate autonomous demand (AAD): "exogenous variables" (i.e. not determined within the model).

But, where are the "Animal Spirits"…?

Hiding inside Co, Io, and c!

Suppose "keynes" -- short for the "average business man" -- feels a bit under the weather and reduces autonomous investment to I1: AAD falls. Multiplied by, well, the multiplier (which didn't change) it yields a smaller Y (say, Y1).

Less workers are needed to produce Y1 than were needed to produce Yo: employment falls, too. An unpredictable change in "spontaneous optimism" causes a fall in autonomous private investment, causing AAD to fall, causing output and employment to fall. Animal Spirits set a recession in motion.

Enter Hicks/Krugman. The government may not control Io, Co, or c, but it controls TRo and Go. If the government increases either of them -- a.k.a. fiscal stimulus -- just enough to offset the shortfall in AAD, the Y recovers to the level of Yo (say Y2 = Yo).

The mechanism -- in this minimalist model -- is deterministic. Randomness intervenes only as the initial exogenous shock; after that, output and employment (plus interest rate and inflation) are predictable:

"And as I have often argued, these past 6 or 7 years have in fact been a triumph for IS-LM. Those of us using IS-LM made predictions about the quiescence of interest rates and inflation that were ridiculed by many on the right, but have been completely borne out in practice. (…) " (Paul Krugman, "Unreal Keynesians")This is the happy ending for Keynesians like Hicks and Krugman (and, apparently, to some Post Keynesians like Cooper and Vernengo): Animal Spirits dropped out of the blue and struck once, but the recession was -- predictably -- solved.

However, that -- as we've seen and as Post Keynesians have insistently argued -- was not necessarily Keynes' happy ending ("If the fear of a Labour Government or a New Deal depresses enterprise, this need not be the result either of a reasonable calculation or of a plot with political intent; it is the mere consequence of upsetting the delicate balance of spontaneous optimism").

It certainly isn't the happy ending for "Austerians": What if the mere announcement of fiscal stimulus further scares "keynes", who again slashes autonomous investment? What if the "psychological propensity to consume", c, falls and with it the multiplier? What if, in other words, Animal Spirits are not exogenous and become the Confidence Fairy?

There's no a priori reason stopping Animal Spirits from striking again.

In more philosophical terms: If the economy, ultra-sensitive to the intestines of "keynes", were unpredictable (uncertain) … -- or, like Old Keynesian economist Paul Davidson likes to say, non-ergodic -- wouldn't that mean that the effects of stabilization policies are also uncertain, unpredictable, non-ergodic, even counterproductive?

----------

References

Dornbusch, R. and Fischer, S. (1994). Macroeconomics. New York: McGraw-Hill

Image Credits:

[A] Totem in Alaska. National Archives and Records Administration. This work is in the public domain. Wikipedia.

Wednesday, 3 June 2015

When Maynard met Naomi.

Ariadne Birnberg writes "Most Beautiful Maynard", the story of her grandmother, Naomi Bentwich, and her lifelong, unrequited, and presumably platonic love for John Maynard Keynes.

Given the differences between its protagonists -- the naively idealistic Jewish woman, and the anti-Semitic gay/bisexual man; Naomi, of middle class extraction, acting as secretary for Keynes, Eton alumnus, elitist, financial speculator, bureaucrat, academic, eugenicist and member of the cultural avant-garde -- the tale Birnberg relates could have easily turned into a farce.

Instead, Birnberg delivers a fascinating and humane account, where the unavoidable absurd is balanced by Birnberg's respect for the subject: Naomi in the foreground, Keynes in the shadow (the brief appearances other notables make, particularly Keynes' biographers, are somewhat less flattering).

----------

In our times of instant celebrity, it would be easy to dismiss Naomi's story as another star-struck fan's harmless eccentricity. It would be deeply short-sighted, too.

She wasn't the only one falling for Keynes' spell. And she wasn't the last one worshipping that hero. There must have been something especial to the man, something evident to many -- then and now -- but unfathomable to me.

In this sense, Birnberg's story works wonderfully as a metaphor for Keynesianism.

----------

A promising first delivery by Birnberg, and a great read for Keynes' fans.

Subscribe to:

Comments (Atom)