If you believe economists and other practitioners, socialism is for pinkos and other touchy-feely weirdos; economics is the realm of the pragmatist/technocrat:

"I like things that work. I'm a macro economist first and foremost. And I don't like things that hide dysfunctionality under metaphysical cloaks. My politics? I'm a bleeding heart, naturally. But I consider them pretty secondary. What works is usually non-ideological, I find."That was true for all practitioners, whether well-established or just aspiring, orthodox or heterodox (the author of the passage above, for instance, is a young and highly heterodox, PoMo/PoKe, wannabe), but particularly so for those of a more mainstream, free-market persuasion.

And to pragmatism you had to add realism, as evidenced by your use of hard data.

How things have changed.

----------

Kenneth Davidson (Fairfax Media) writes on the Abbott/Hockey make-believe debt crisis, to complain most will be unfairly hurt and he is old-fashioned enough to use data:

"The truth is the Commonwealth doesn't have a debt problem. Estimated net debt in 2013-14 is $197.8 billion, or 12% of gross domestic product - one of the lowest of the mature industrial countries…Mind you, he is not the only one. Sean Carmody, from Stubborn Mule, commenting on the chart below:

"According to these criteria, the budget deficit [sic] in 2014-15 is one of the most deflationary on record. It will withdraw $20 billion from the income expenditure stream, compared with an injection of $31 billion into the income expenditure stream in 2013-14.

"This is a massive deflationary turnaround of $51 billion in the impact of the budget on the economy (equal to a reduction of 3.2 per cent of GDP)" (here)

|

| (source) |

"Despite Hockey's concerns about a budget emergency, Australia [i.e. the "+" in the chart] is a wealthy country with a relatively low rate of government spending. Among these 30 countries, only Switzerland and South Korea spend less." (here)So, is not just that public debt is currently low (as Davidson correctly says), it's that spending is already constrained, so debt doesn't have to "explode".

Another who makes ample use of data is Bill Mitchell, from Billiblog. Although Mitchell cites many reasons why spending cuts are counterproductive, I'll mention two, only:

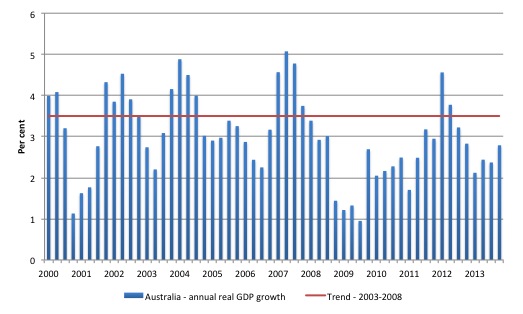

GDP growth is well below trend and public spending is needed:

|

| (source) |

And labour underutilization is high and rising:

|

| (source) |

This is how Mitchell concludes:

"Overall, a very predictable fiscal statement from a nasty government that is keen to do the bidding of the elites and big business and use the rest of the citizens, particularly the weakest among as, as pawns in their wealth-generating activities.

"It will reduce growth and increase joblessness.

"It will increase hardship on those least able to cope with it.

"And why? For no substantive economic reason. This is not an economic statement. The annual fiscal statement has become an annual statement of dogma from a deeply flawed economic paradigm." (here)

----------

How do the supporters of the Abbott/Hockey debt crisis thesis argue their case?

Phil Bowen, whom the free-marketeer Australian Financial Review identifies as "Parliament's independent budget adviser" (why do they need one?), adds no details, just says he does not agree the federal budget cuts were built on a manufactured crisis, waves his hands, and reiterates Hockey's message:

" 'If you just continued on the trajectory of payments and revenues prior to the budget, net debt is forecast to grow rapidly, I think, at the highest rate in the OECD,' Mr Bowen said.And Leith van Onselen, from Macrobusiness, in his own data-free post says:

" 'I don't think that's a fiction at all, but neither am I saying that we have an immediate emergency.'

"Mr Bowen said it was the trajectory of net debt, rather than the level compared with other countries, that concerned him.

"' Sure we're currently at a very low level relative to the rest of the developed world, but frankly we don't want to find ourselves where the rest of the world is,' he said." (here)

"While I agree with Davidson that increasing public debt is not necessarily 'bad' if it is used to boost the productive capacity of the economy and raise living standards - making the extra debt 'self-liquidating' - I do feel that he has underplayed the very real medium to longer-term pressures facing the Budget as the once-in-a-century mining boom unwinds and the population ages." (Emphasis added; here)So there. Bugger the data. It's all a matter of "feelings" and "concerns".

That's not good enough, even though these are individuals expressing their personal feelings and worries only.

But it gets worse. Abbott and Hockey don't have that excuse: their "feelings" and "worries", their hysteria will not only hurt us at the bottom of the pecking order, they may yet throw Australia into a recession.

No comments:

Post a Comment